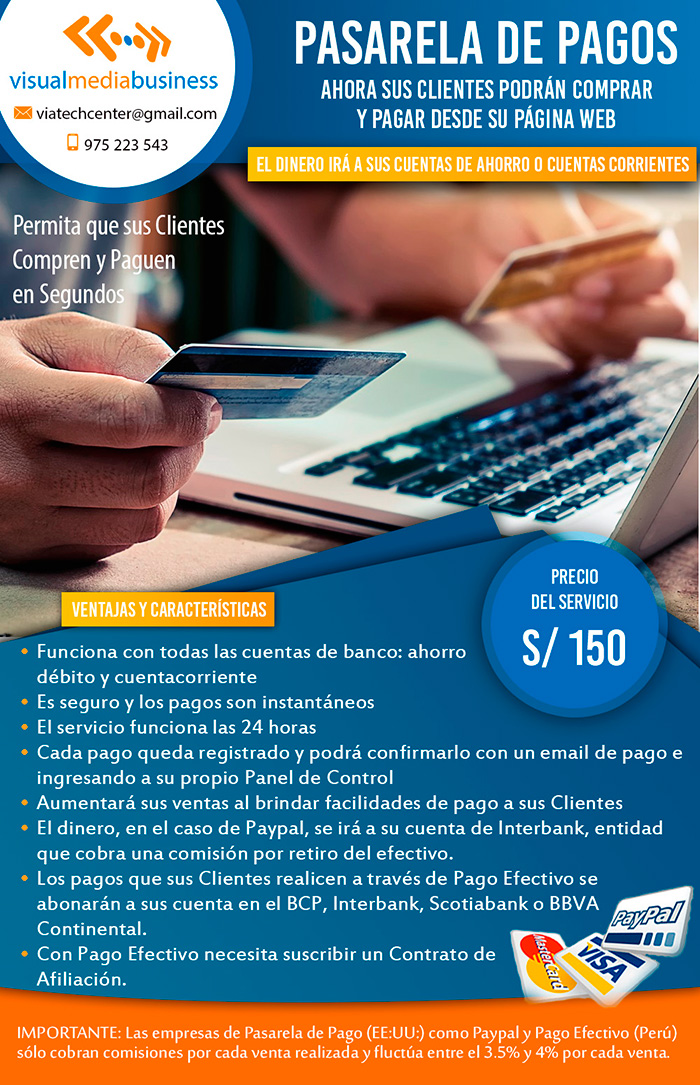

Aprenda a manejar paso a paso su propia Pasarela de Pagos. Venda sus productos y reciba dinero desde cualquier parte del mundo. Automáticamente el dinero será depositado en su cuenta de banco. Podrá recibir pagos hechos con cualquier tarjeta de débito o crédito. Los pagos serán realizados a través de una plataforma segura, encriptada y difícil de descrifrar.

Con una Pasarela de Pagos propia su Página Web actuará como si fuera un Banco: cobrará el dinero por usted, lo depositará en su cuenta, le informará respecto al o los abonos efectuados a diario, por semana y al mes.

La Pasarela de Pago también se encargará de proveer de la máxima seguridad a las transacciones efectuadas por sus clientes. Con la más avanzada tecnología de encriptación, los datos de sus clientes viajarán por Internet totalmente seguros y libres de cualquier riesgo.

Asimismo, junto a su plataforma de eCommerce, sus Clientes sabrán al instanambiar el estattute el estado de su pedido: si está pendiente, en camino, entregado o si ha sido cancelado. Su Tienda Virtual le listará los pedidos del día y usted sólo deberá modificar el estado de cada uno de los pedidos, de acuerdo al avance en el proceso de despacho y entrega.